China

No Result Found

A Critical Choice: Loosening China’s Control of Copper

November 14, 2023

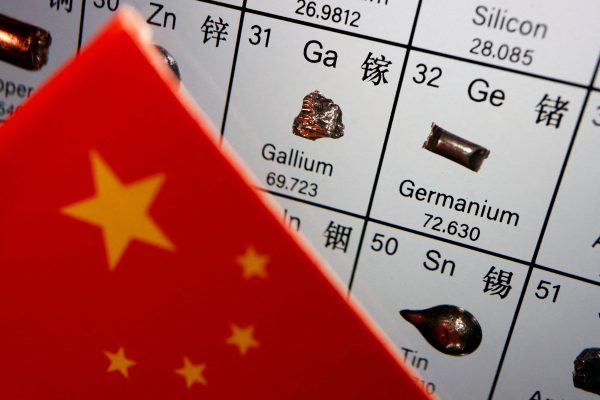

Gallium, Germanium, and China — The Minerals Inflaming the Global Chip War

August 8, 2023

Part Two: Is AI a Threat or Opportunity For Democracies?

August 2, 2023

Part One: Watch Out Russia and China: AI is a Threat

August 1, 2023

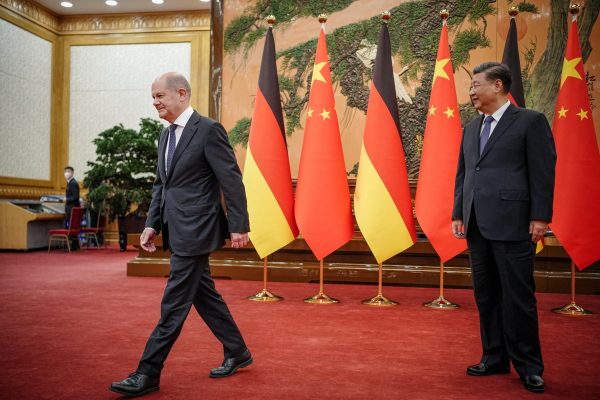

Germany’s Chinese Tech Love Affair Fades

July 26, 2023

Marco Polo, Step Aside: Italy Cools on China

July 14, 2023

Losing the Transatlantic Battle for Critical Minerals?

June 29, 2023

Sanctions Against Russia Are More Effective Than Skeptics Suggest

February 27, 2023

Chinese Media Influence: Lessons Learned from Central and Eastern Europe

January 17, 2023