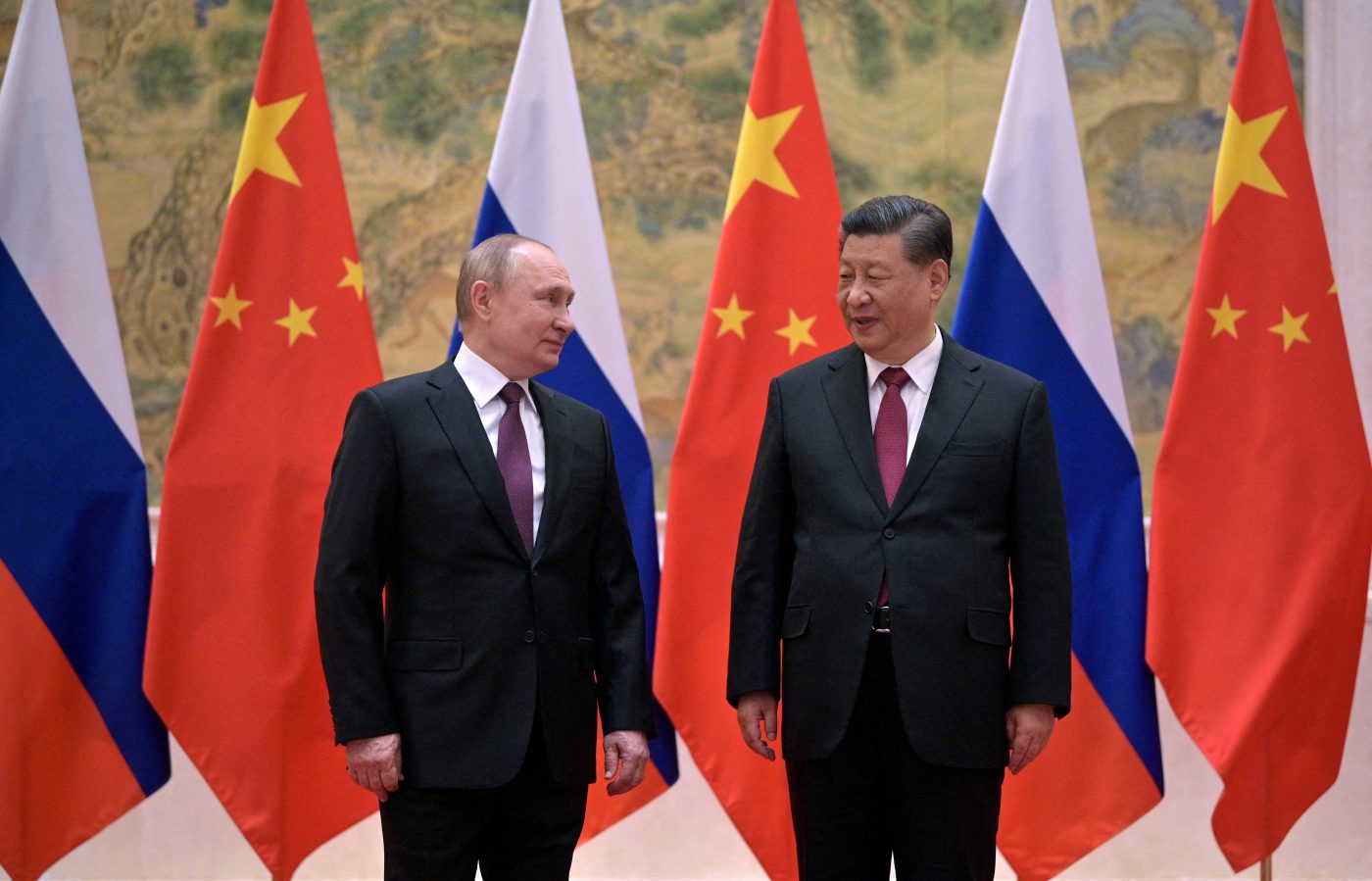

Vladimir Putin’s visit to China for the third Belt and Road Initiative (BRI) forum was intended to demonstrate the endurance of the special partnership between the two countries.

The visit also took place amid the unfolding crisis in the Middle East where Israel is readying its forces to dismantle Hamas. Russia and China were fairly restrained following the October 7 Hamas pogrom, but as time went by both became more vocal in their support for the Palestinian side by criticizing Israel.

This alignment underscores the two Eurasian countries’ geopolitical ambitions as a counter to the collective West, and can be seen in a range of activities from technology to military affairs and their joint hostility to the rules-based international order.

So Putin’s October 17 trip might have marked a big moment in their “no limits” partnership. And indeed the Russian leader was hailed as a special guest and was courted by his counterpart Xi Jinping.

But it wasn’t quite as Putin would have liked. First, the relationship is not only heavily unbalanced, with China playing the big brother role, but it is also becoming more so (China’s current GDP is now eight times bigger than Russia’s.) Russia is a supplicant, in dire need of its eastern neighbor both economically and diplomatically.

Its practical dependence on China has also risen. For instance, over a third of all Russia’s crude oil exports — or around 2 million barrels per day — go to China. In another example, China has filled the void left by Western businesses in the Russian consumer market. Today, for instance, one out of every two automobiles sold in Russia is imported from China. Prior to the conflict, China sold very few cars to Russia.

Indeed, underneath the grandiose reception given to Putin, his hosts remain highly pragmatic when it comes to Russia. For instance, the Power of Siberia 2 project – a major, 3,000km gas pipeline from Russia to China — shows no significant progress despite intensive negotiations. In an age when China is making serious strides toward renewable energy, investing in the project will be a tough sell for Russia, as will getting China to agree on a good price.

Even if built, the pipeline is unlikely to fill in the gap that emerged following the disruption of Russian gas and oil supplies to Central and Western Europe. Russia had, prior to the all-out invasion of Ukraine, shipped over 170 billion cubic meters (bcm) of gas to Western Europe. Power of Siberia 2 would have a capacity of 50 bcm annually, while the existing Power of Siberia 1 pipeline can transport just 38 bcm. Even with an additional 10 bcm supply contract from the Sakhalin offshore gas fields, the total would be 98 bcm, even when the new pipeline is finally built, perhaps in 2030.

All of this assumes that China wants Russian gas given its push to diversify energy sources and an unwillingness to rely mainly on the Kremlin (which, remember, has shown beyond doubt that it will use energy as a political weapon.)

Russia also seeks a grain deal. Last year, foreign grain sales contributed over $41bn to the country’s GDP. Thus, there were expectations among Russian agribusinesses that Putin might achieve this during his Beijing trip. It is still hard to know what happened — while the state-run TASS news agency said that a massive grain contract, valued at $25bn, had been signed, there was no confirmation from Chinese sources.

While it is true that China has, broadly speaking, offered diplomatic and some military support to the Putin regime since Russia’s all-out war on Ukraine began 20 months ago, it is far from unqualified.

As the fighting in Ukraine has largely stabilized along the established line of contact and the threat to Russia’s internal stability has waned following the August mutiny, Beijing now has less incentive to throw its full support behind the Kremlin.

That does not however mean that China’s communists are anywhere near abandoning Russia. They will continue supporting Russia to ensure it stays afloat. The calculus remains unchanged: an aggressive but weakening Russia is the best possible tool to distract the West from China.

Emil Avialian is a professor at European University and the Director of Middle East Studies at the Georgian think-tank, Geocase.

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions are those of the author and do not necessarily represent the position or views of the institutions they represent or the Center for European Policy Analysis.