The Russia whisperers are back in business.

The Americans, according to Tino Chrupalla, co-chair of the German far-right AfD party, have profited from Russia’s war in Ukraine by forcing the Europeans to buy its more expensive, “dirty shale gas.”

This line of argument is gleefully followed by other European extremists who argue that Europe has swapped one geopolitical vulnerability — its dependence on Russian pipeline gas — for another, which is US-sourced liquefied natural gas (LNG.)

The arguments are popular among the continent’s anti-American voices. As usual, the facts cited by the far-right and far-left contain some truth, though the conclusions are distortions or crowd-pleasing simplicities.

The first is that the “Americans persuaded European buyers to switch to more expensive US LNG.”

The key distortion here is “persuaded”, because while it’s true that Europe has switched, it was urgently seeking new suppliers once Russia had cut 80% of its pipeline supplies to Europe last year (mistakenly believing its blackmail would persuade Western partners to discontinue support for Ukraine).

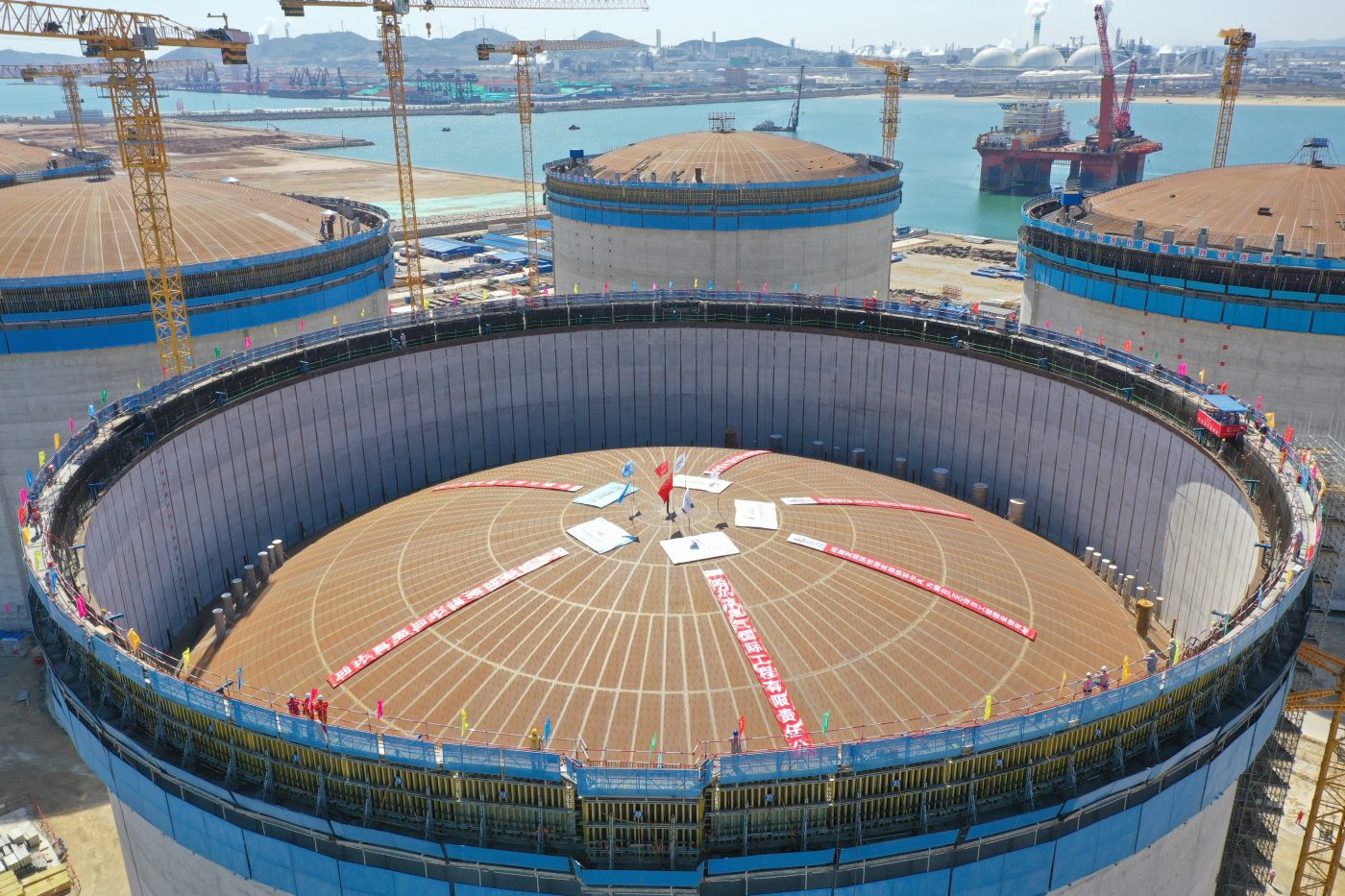

In fact, Russia’s decision to curtail supplies forced countries to take decisions that were long overdue, such as fast-tracking the deployment of renewable capacity or building new importing capacity for LNG.

In the absence of Russian gas, Europe turned to the global LNG market, buying a record 155 billion cubic meters in 2022, a 71% increase from the previous year.

While it is true that around half of these volumes were sourced in the US — hardly surprising given it’s one of the world’s largest producers — companies in Africa, Australia, Indonesia, or Peru also sold LNG to European markets.

Small- or medium-sized European importers such as Croatia or Greece saw a real diversification, importing cargoes from far-flung corners of the world that would not have normally been sources for natural gas.

This shift did not occur because of the US or anyone other than Russia. The only geopolitical sleight-of-hand was the Kremlin’s.

Once Russia pushed gas prices to record levels, alternative suppliers in remote places responded to the price signals. This is not a victim-led conspiracy, it is market economics.

In fact, Europe’s functional gas markets, sarcastically dismissed by former Russian Gazprom chairman Dmitry Medvedev as the “most stupid idea in modern economic history” saved countries from the Russian-inflicted crisis by accurately reflecting the shortfall needing to be plugged. That did push prices higher, and in fact took Europe to the brink of social and economic turmoil.

The second fallacy spread by anti-American critics is that Russian gas prices were cheap.

While it is true that some Western buyers benefitted from “loyalty” discounts, the same could not be said about Eastern European consumers who have historically paid some of the highest prices and were repeatedly subjected to Russia’s gas blackmail often in midwinter.

In hindsight, Western buyers may now have reached the overdue conclusion that the supposedly cheap Russian gas came at an overinflated price to their own security, something rammed home the moment Russia launched its full-scale invasion of Ukraine and hybrid war against Europe in 2022.

The third and final fallacy is that by increasing the US LNG supply, Europe has swapped one geopolitical dependence for another.

While last year’s Russian gas curtailments did demonstrate, once again, that the Kremlin viewed energy supplies as a means to exert political control over Europe, the same argument cannot be made about the US.

This is because unlike Russia, in the US there is a constellation of private producers who sell natural gas based on commercial interests driven by market prices rather than political diktats. In short, the White House does not play the same games as the Kremlin.

Ironically, the same experts who suggest Europe has now increased its dependence on US LNG also point out that these volumes could be directed to China should Asian buyers offer premium prices. Which contradicts the argument that the sale of US LNG was politically dictated.

More ironic still is the fact that China, America’s largest geopolitical rival, has secured LNG contracts with US suppliers for the next 20 years.

These volumes are not only forecast to remain stable for the stated period but, as of now, represent the largest share of China’s total gas imports in the longer term.

If China had perceived any geopolitical risk by increasing its dependence on US LNG it would have stayed well clear, opting instead to secure supplies from friendly producers such as Russia.

China is not only delaying the expansion of its Russian imports but, unless something changes, deliveries are set to taper off from the second half of 2030.

In fact, China’s decision to lock in US LNG supplies despite the ongoing geopolitical rivalry with Washington belies its (correct) assessment of the fact that the US gas business is driven by commercial considerations.

Chrupalla and Russia’s European cheerleaders could draw meaningful conclusions from China’s understanding of the fundamentals. But there are few populist points to be scored from an acknowledgment of global realities.

Dr. Aura Sabadus is a senior energy journalist who writes about Eastern Europe, Turkey, and Ukraine for Independent Commodity Intelligence Services (ICIS), a London-based global energy and petrochemicals news and market data provider.

Any views expressed are her own.

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions are those of the author and do not necessarily represent the position or views of the institutions they represent or the Center for European Policy Analysis.