Under the new DMA regulation, “gatekeepers” are defined according to objective revenue, market capitalization, and user numbers. Google, Amazon, Apple, Facebook, Microsoft, and Byte Dance qualify. All are US firms with the exception of the Chinese owner of TikTok.

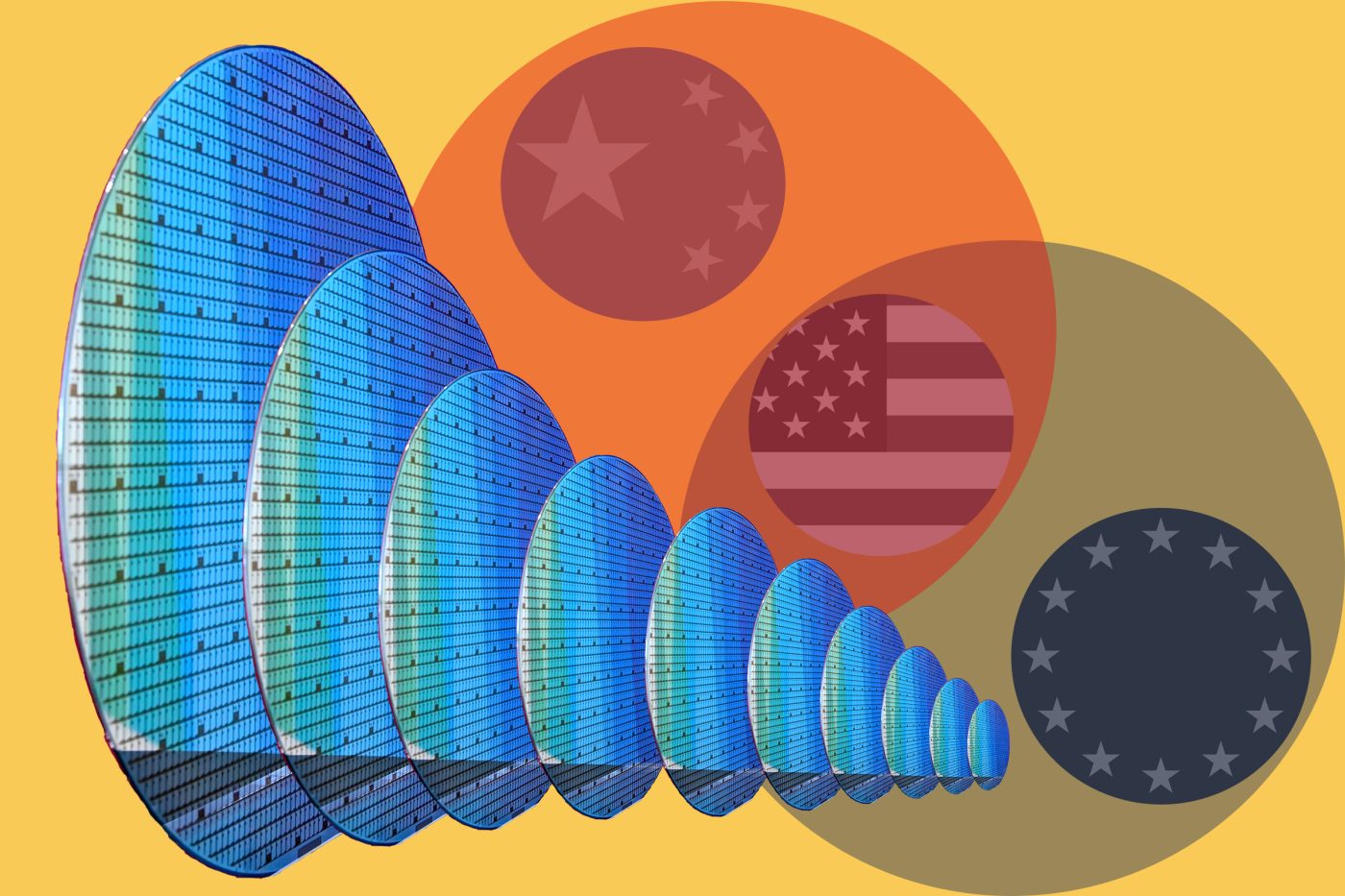

Some see a list with only non-European firms as protectionist, especially at a time when the European Union is promoting “digital sovereignty.” But the EU does not boast large digital platforms and the biggest beneficiaries will be, hard as it may to believe, the US gatekeepers.

The DMA could still be protectionist if it aims to help European competitors. European policymakers say they have two goals: first, to inject competition into digital markets, making it easier for challengers to displace the incumbents, and second, to make digital markets fair, preventing gatekeepers from using their power to obtain disproportionate advantage.

DMA’s fairness obligations could help European firms. Sweden’s Spotify welcomed the regulation, hoping to lower the commission fees paid to Apple’s App Store. But Amazon will also benefit from those lower fees (if they materialize). So fairness is likely to benefit both EU and non-EU firms.

The DMA’s other, perhaps more ambitious, goal is to promote contestability, in other words, to dethrone gatekeepers. The open question is which challengers will take their throne. Here, antitrust history offers surprising clues.

The DMA obliges gatekeeper mobile operating system providers (Apple and Google) to offer their users a choice of browsers, search engines, and virtual assistants. We’ve seen this before. In 2009, Microsoft resolved the Commission’s second case against it by offering a “browser ballot” that prompted users to choose between one of the five most popular browsers. After the decision, Google Chrome took the market leader spot from Microsoft’s Internet Explorer.

While it is still debated to which extent the browser ballot contributed to this shift, it is no surprise that a US firm took advantage. When iPhone users are faced with Apple’s browser ballot, it is likely that the main beneficiary will be Google’s Chrome. Alternatively, it might become Microsoft’s Edge, which recently received an artificial intelligence upgrade. But it is difficult to imagine a future where an EU browser such as Opera rises to gatekeeper status.

Google stands to benefit in other ways. The company reportedly pays Apple $18 billion per year to make its search engine the default choice in Safari. Under the DMA, such default placements are outlawed. Google will save billions of dollars in the EU, likely without losing significant market share.

This is not mere speculation. US firms have already shown themselves eager to take advantage of the DMA. Epic Games has emerged as the fiercest advocate of forcing Apple to allow competing apps. Behind the scenes, Microsoft and Facebook have lobbied the European regulators to reject Apple’s compliance plans.

Such lobbying is not new. European digital antitrust enforcement was criticized as protectionist, while many of the complainants were US firms. Microsoft drove the first European investigation into Google. Earlier, Sun Microsystems pushed the EU’s case against Microsoft.

Many reasons explain the EU’s inability to produce tech giants, including underdeveloped capital markets, punitive bankruptcy laws, and the absence of a proactive immigration policy. As a result, the most serious potential challengers are American.

US startups will not be these challengers, either. Only the large gatekeepers have the needed resources and infrastructure to take advantage of the DMA. Microsoft, for example, is the sole company besides Google that owns an at-scale English-language web index. If Google is to lose the search engine throne, Bing is the best bet to emerge as the new king. That outcome certainly will not be the mark of a protectionist policy.

Friso Bostoen is an assistant professor of competition law and digital regulation at Tilburg University.

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

2025 CEPA Forum Tech & Security Conference

Explore the latest from the conference.