The official ceremony to mark the start of construction of the China-Kyrgyzstan-Uzbekistan (CKU) railway was held on December 27. The event featured high-level officials from Beijing and Central Asian states and followed the signing of an investment agreement a week earlier.

The line, which is designed to carry 10-12 million tons of cargo a year, will stretch approximately 486km (302 miles), linking Kashgar in Western China to Andijan in Uzbekistan and passing through the mountains of Kyrgyzstan.

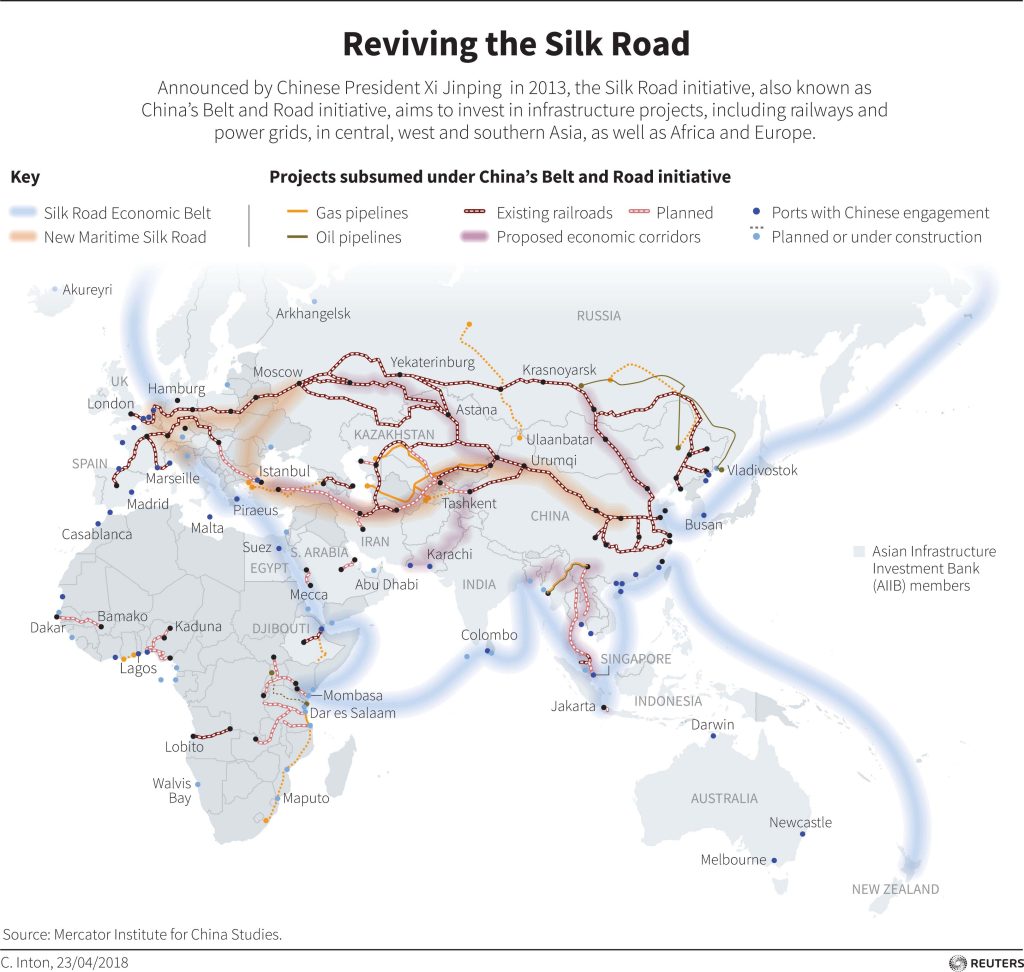

It will provide both countries with a direct link to China, bypassing their current reliance on routes through Kazakhstan, while also offering an opportunity to boost trade with Europe and the Middle East.

Beijing sees the railway as a way of bolstering exports to Europe and speeding up imports of Central Asian raw materials and agricultural goods.

Central Asian states will also have greater access to global markets as the railway will connect them with the Caspian Sea and the European Union via Georgia’s Black Sea shore, where China is building a deep seaport at Anaklia.

The CKU was first mooted after the collapse of the Soviet Union and, despite occasional discussions, has been stalled ever since by perennial instability in Kyrgyzstan and Russian opposition to a major infrastructure project that bypasses its territory. The lack of financing for Kyrgyzstan’s 200 miles of the project was another major stumbling block.

Things began to change in earnest in May 2024 when Kyrgyz President Sadyr Japarov said work would begin later that year. In June, the three countries agreed a financing plan and the establishment of a joint company, with a 51% Chinese controlling stake and the rest equally divided between Kyrgyzstan and Uzbekistan.

The Chinese government promised a $2.35bn low-interest loan to cover half the projected $4.7bn construction cost and agreed to provide $1.2bn of the balance, while Kyrgyzstan and Uzbekistan would each be responsible for around $573m.

Russia’s status as an international pariah was a key factor in the decision to start work on the project. The full-scale invasion of Ukraine, and the ensuing raft of Western sanctions, prompted shipping companies to look for alternatives that avoided Russia.

For decades it had provided a convenient channel for trade between China and the EU, but after February 2022 the need for other reliable routes was clear. And the search was made more urgent by growing concern over the Red Sea and other alternatives.

Despite the fanfare over potential reductions in costs and transit times, it will be several years before the railway is operational. Major construction efforts will only begin later in this year and there are varying estimates of how many stations, bridges, and tunnels will have to be built.

Whether China follows through with the project will be a demonstration of its commitment to the line and its vision of a “Middle Corridor” to the West.

The Kremlin’s fears about the real meaning of all this are understandable. If implemented, the CKU railway will transform connectivity in Central Asia, a region China has long loomed over because of growing bilateral trade, investment, and security cooperation. The new line will enable China to build further momentum behind its drive for East-West connectivity.

Whatever its concerns, there is little Russia can do to counteract the project or suggest a meaningful alternative. Moscow’s preoccupation with its war in Ukraine, its need for war-related Chinese goods, and the recent loss of geopolitical status from the failure to protect its Syrian ally, mean it cannot jeopardize its close links with Beijing.

To be sure, not all Central Asian countries are especially happy about the project either.

Kazakhstan, for example, which has positioned itself as a key hub for East-West trade, might see its role diminish. It is probably no coincidence that Astana announced in January it will be upgrading and adding to its own vast rail network.

If the project goes ahead, the EU and the US can expect to benefit from a Central Asia which is more open. After all, freeing the region of Russian influence has been a major geopolitical objective ever since the 1990s.

But the driver of change is China, a power which is far stronger than Russia and increasingly seen as a threat by both Brussels and Washington.

Emil Avdaliani is a professor of international relations at the European University in Tbilisi, Georgia, and a scholar of Silk Roads. He can be reached on Twitter/X at @emilavdaliani.

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions expressed on Europe’s Edge are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

War Without End

Russia’s Shadow Warfare

CEPA Forum 2025

Explore CEPA’s flagship event.