Forget laissez-faire economics. In order to compete against China, Washington no longer believes that market forces alone will protect America, and the government is taking stakes in firms critical to the production of semiconductors, rare earths, lithium, and other strategic inputs.

Despite the dangers of political interference, the strategic logic is compelling. In industries where scale and continuity are essential, such as semiconductor manufacturing or rare-earth processing, equity investments act as a stabilizing anchor. They help deter foreign takeovers. They stabilize balance sheets and crowd in private investment. They signal that the US views these companies as long-term national assets, without resorting to heavy-handed control.

The recent 2025 National Security Strategy commits the US to identifying “strategic acquisition and investment opportunities for American companies,” backed by a dense web of public financing tools ranging from the Development Finance Corporation and Export-Import Bank to the U.S. Departments of State, War, and Energy. The strategy recasts competitiveness as a matter of coordinated state support.

Several European states have long taken similar steps. Germany acquired a 17% stake in energy giant Uniper to secure national energy resilience after Russia’s invasion of Ukraine. France has repeatedly taken positions in its nuclear and aerospace sectors. Italy’s government has backed strategic acquisitions in telecommunications and critical infrastructure.

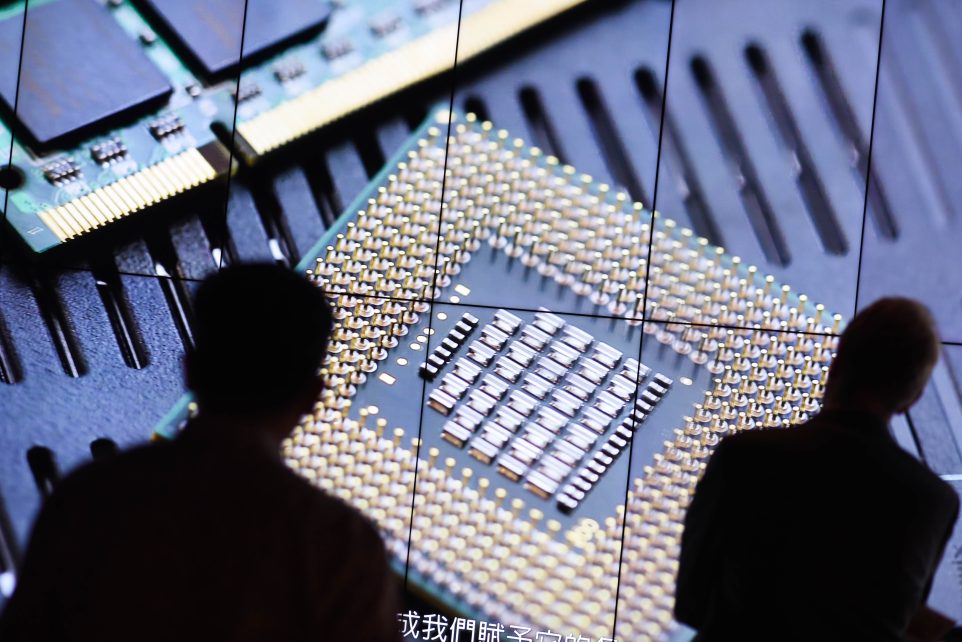

Democratic governments view minority equity stakes as legitimate instruments to safeguard critical industries. In the US, the most visible symbol is MP Materials, the owner of America’s only rare earth mine. The US Department of War became the largest shareholder and committed a $150 million loan to produce magnets. Prior to the US acquisition, Shenghe Resources, a partially state-owned Chinese firm, was a major shareholder in MP Materials and formerly its primary customer. The US has also acquired a 9.9% stake in Intel, the only major US chip manufacturer, with a warrant for additional shares.

Historically, the US took direct equity investments only in moments of acute financial crisis or wartime necessity. The last major episode was during the 2008 financial crisis. Washington stabilized collapsing banks and key firms by injecting capital into major financial institutions in exchange for preferred shares and warrants. The government also acquired controlling stakes in General Motors and a substantial share in Chrysler’s parent company to prevent their bankruptcy. These positions were explicitly temporary: once the firms implemented the structural reforms and governance changes required by the government, the public stakes were unwound and sold.

China’s model of state capitalism is different. Beijing built its industrial power through pervasive state ownership, the central direction of credit, and the use of state-owned enterprises as instruments of strategic policy — from rare-earth mining and processing to semiconductors, shipbuilding, and telecommunications.

By contrast, US government stakes in critical firms are non-controlling and do not entail operational direction. They are not designed to replace markets with state control, but to safeguard the market presence of key US firms in strategically vital sectors.

Yet, this approach is not without risks.

Once the government becomes a shareholder, the temptation to serve political rather than commercial objectives can grow. Politicians may pressure firms to preserve unprofitable domestic facilities, favor politically connected suppliers, or avoid necessary layoffs. In Europe, government ownership translated into protection for inefficient state-backed airlines and carmakers rather than support for competitive innovation. These pitfalls underscore the importance of maintaining strict limits on state involvement and ensuring that equity positions remain non-controlling or even time-bound.

Even so, this emergent model of strategic equity investment may well be a prudent way for the US to ensure strategic autonomy and industrial sovereignty, while defending a broadly open, innovation-driven global economy. Washington is no longer content to regulate or subsidize — it is willing to buy security, at home and abroad.

Elly Rostoum is a Senior Resident Fellow with the Center for European Policy Analysis (CEPA).

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.