Score another win for China. The Dutch government placed Nexperia — headquartered in the Netherlands but owned by China’s Wingtech — under emergency state supervision. Washington had reportedly urged the Hague to act, worried that Chinese ownership of a European semiconductor firm posed strategic risks.

Beijing retaliated. China blocked exports of Nexperia-produced chips from its own factories, jolting Europe’s automotive and electronics supply chains. Within days, the shock was felt across Europe’s powerful automotive industry.

Then came an extraordinary step: Nexperia’s Chinese subsidiary sent a letter telling employees to ignore directives from the Dutch headquarters and continue operations as usual — an open assertion of Chinese authority over a European-regulated parent firm. By mid-November, the Dutch government abruptly suspended its intervention. Business resumes more or less as normal.

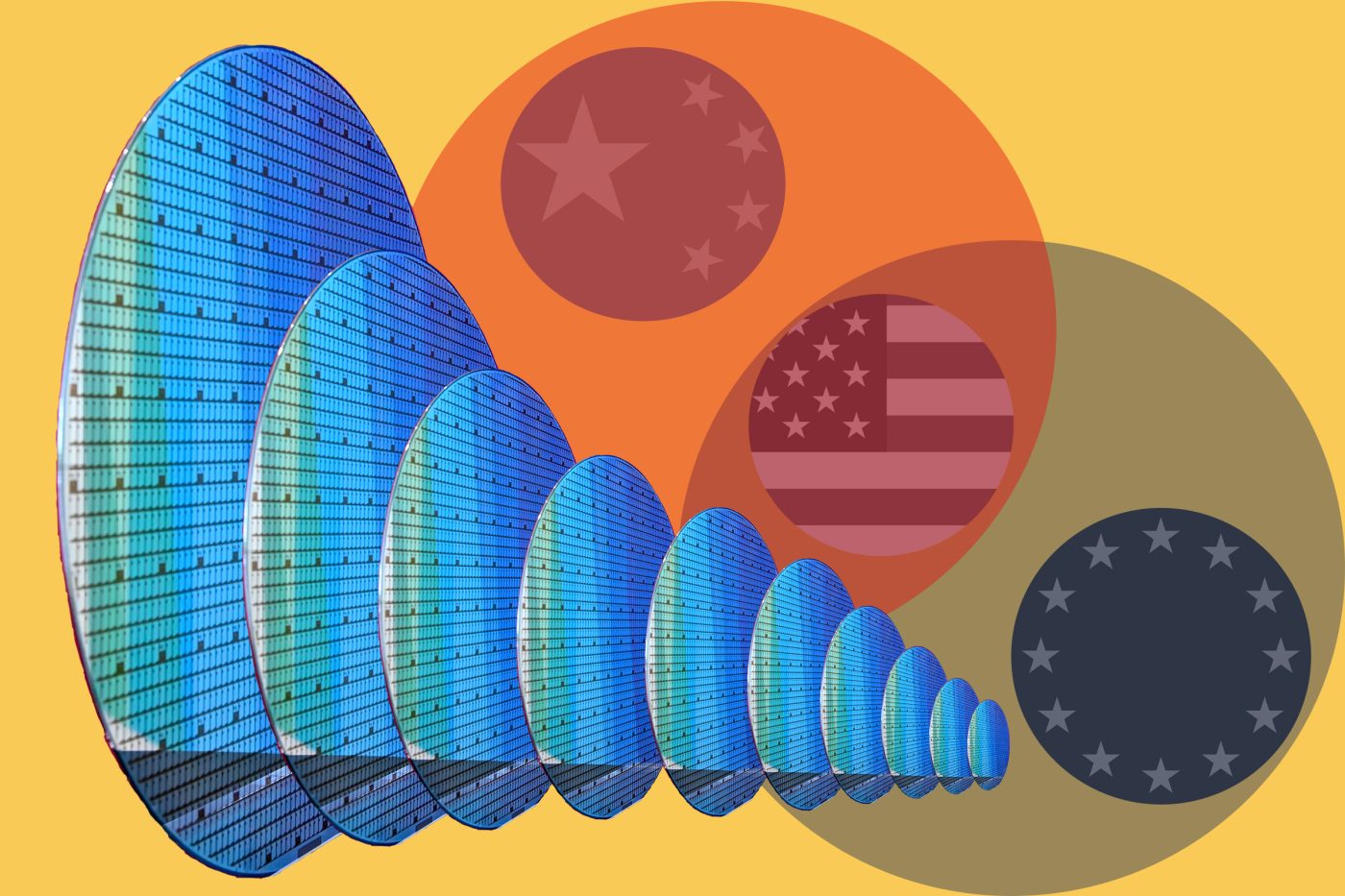

The Nexperia battle underlines several important lessons. While the dispute was framed as a battle over semiconductor security, it is fundamentally about ownership — who holds sway over the firms, factories, and supply chains that anchor the modern economy? Who owns the fabs? Who commands the boards? Who controls the flow of components, minerals, and materials? Who can shut them off?

China can. And the Nexperia incident shows how and why.

Beijing used the same playbook only a month earlier, when it cut Europe out of parts of the rare earths supply chain after Washington imposed tariffs on Chinese goods. Europe had not imposed the tariffs, yet it was punished anyway. The message was unmistakable: in a world of interlinked production, China can strike where it hurts.

The US is also vulnerable. When Washington imposed tariffs around the globe, China flexed its muscles by halting critical mineral exports and magnets crucial for the world’s car, semiconductor, and aerospace industries. The strategy worked. China agreed only to pause critical mineral export controls for a year. In return, the US cut its tariffs and will allow China to buy sophisticated semiconductors.

This structural leverage extends far beyond chips. China dominates the production of battery precursors and a huge share of global active pharmaceutical ingredient manufacturing. It controls key nodes in solar, EV, and electronics supply chains. The US may lead in innovation, but China leads in capacity, and it is fast catching up in design and innovation, too.

Nexperia is the latest reminder that the global industrial system is now inseparable from Chinese manufacturing muscle. Four decades of globalization — encouraged and celebrated by the US and Europe in the 1980s and 1990s — created a world where efficiency trumped resilience. Production was dispersed, ownership crossed borders, and supply chains threaded through continents. The system delivered growth, low costs, and global scale. It also produced vulnerabilities that are now impossible to unwind without severe economic pain.

That is the core dilemma now facing the transatlantic alliance. Policymakers talk about “de-risking,” yet regularly flirt with the harder idea of “decoupling.” Nexperia demonstrates why decoupling, outside of niche markets, is a fantasy. China’s retaliation against Europe, and its willingness to bypass Dutch regulators entirely, exposes the costs of trying to push China out of critical supply chains. Those costs are not abstract. They materialize as material shortages and destabilized industries.

Although other Asian countries, such as Vietnam, India, or the Philippines, have built meaningful back-end manufacturing capacity, global supply chains cannot simply be rerouted overnight. The system is too complex, the dependencies too deep, and the contracts too entrenched. Re-creating China’s scale would require enormous capital outlays and years of coordinated investment — costs that would require both a whole-of-government approach and significant public-private partnerships to plausibly absorb.

Ironically, Nexperia acquired Newport Wafer Fab in the United Kingdom in 2021. London forced Nexperia to sell its stake over national security worries. But the era in which Washington or London could unilaterally force a Chinese company to divest is ending. Beijing has become far more assertive and intent on maintaining its position as a global industrial hegemon.

The Dutch government’s decision to pause its intervention was framed as diplomatic goodwill. It is strategic realism. Europe cannot secure its supply chains by decree alone. China is too embedded, too indispensable, and too capable of punitive countermeasures.

That does not mean Europe, or the United States, should abandon efforts to protect critical technologies. But it does mean that defensive tools must be matched with a coordinated strategy for managed engagement with China, at least in the short to medium term. The alternative is a cycle of confrontation and retaliation that both the US and Europe are ill-equipped to win without ongoing cooperation, and that only further exposes American and European vulnerabilities to China.

Supply chains are instruments of statecraft where great-power rivalry is unfolding. The US might have spearheaded the globalized system that created economic interdependence, but China now wields a lot of the power it confers. And Europe — wedged between two superpowers yet entangled with both — must learn to navigate a world in which autonomy cannot be asserted without reckoning with dependence.

Elly Rostoum is a Senior Resident Fellow with the Center for European Policy Analysis (CEPA). Non-resident Senior Fellow Christopher Cyteria contributed reporting from the UK.

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

2025 CEPA Forum Tech & Security Conference

Explore the latest from the conference.