US District Judge Amit Mehta’s verdict was clear: Google has abused an illegal monopoly in web search. His challenge now is to find a meaningful solution to boost competition. That will be hard.

Europe’s attempts to dent Google have failed to dent the company’s dominance or profits. While the US ruling could force deep changes, the search company could emerge unscathed, or even reinforced. So long as users believe Google search is the best option, the competition will struggle, or even, in Apple and Samsung’s case, suffer.

I understand this dynamic firsthand. On my first day at work at Google, September 1, 2008, the company launched its new Chrome browser. Six months later, the European Commission opened an antitrust case against Microsoft for its Internet Explorer monopoly. My assignment at Google was to help lead the battle to “free the browser.”

In 2009, a year after opening its case, the European Commission forced Microsoft to ensure true browser choice, installing a start-up screen for users to pick their browser. Today, Chrome is the world’s number one browser. In 2015, Microsoft closed down Explorer.

Although this story suggests regulatory pressure worked, the real change came in the marketplace. Chrome was a superior product to Explorer. It loaded faster and you could print straight from the browser. The Brussels-imposed choice screen did not drive the switch. The market did.

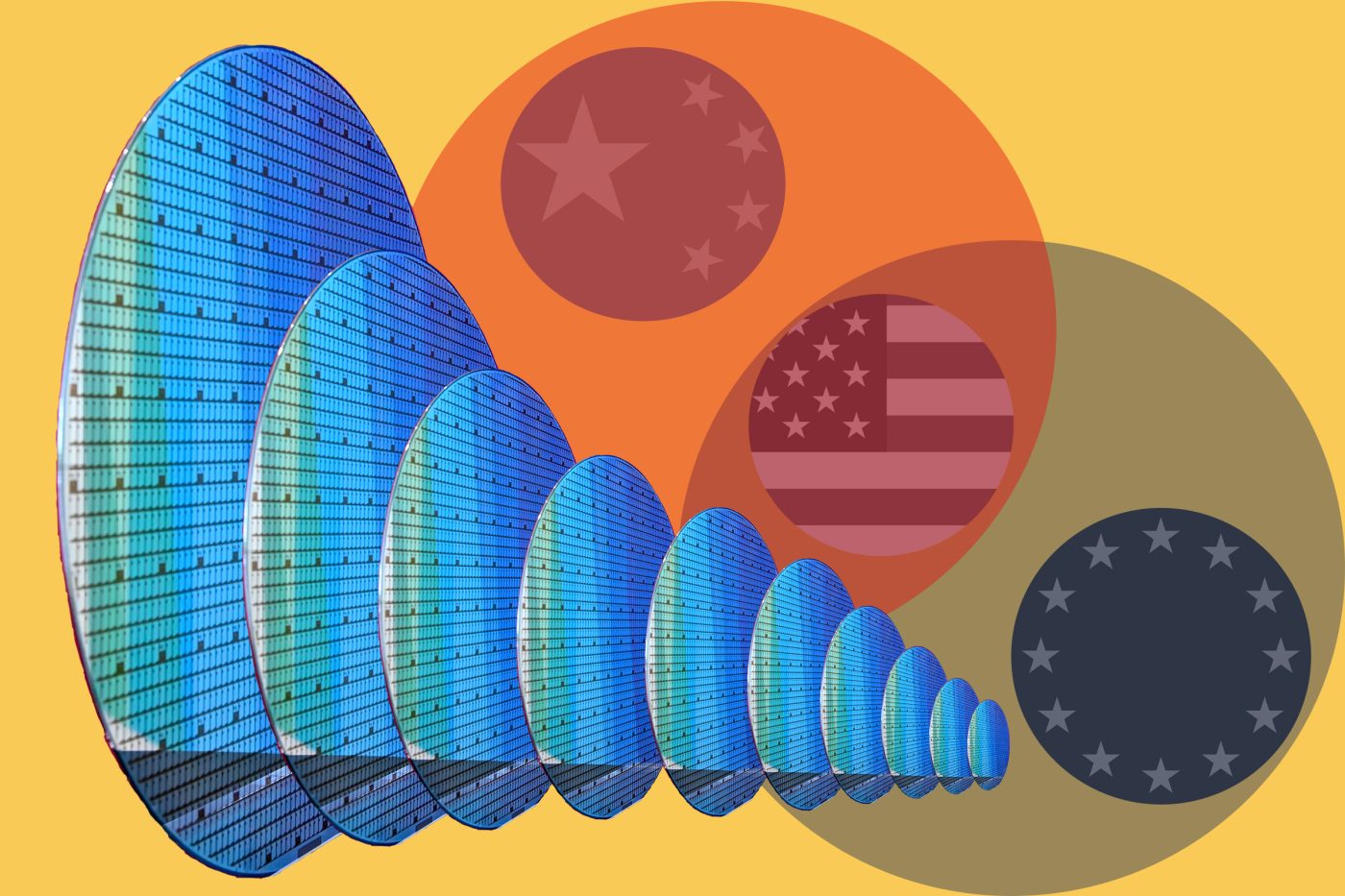

Today’s new regulatory efforts will find it difficult to fare any better in altering market dynamics. Europe’s new Digital Markets Act forces designated digital “gatekeepers” to change their products. It requires Apple phones to allow rival products and services to function with its devices. It prohibits Google from ranking its products at the top of many search engine results. For example, search for a flight and Google no longer puts its flight comparison service, Google Flights, at the top.

Instead of generating new competition, the DMA-forced changes have degraded products. Europeans no longer receive an immediate list of flights and prices from various airlines. They are directed to various airline sites. Google no longer redirects users from search results to Google Maps. When looking for an address in Europe, a single click on a map is used to suffice. Today, numerous additional clicks are required to arrive at the destination.

No doubt, the US ruling remains significant and will influence other US government antitrust lawsuits against tech companies such as Apple, Amazon, and Meta. It is the first major US antitrust verdict against a major tech company since Microsoft was convicted in 2000 of abusing its Windows monopoly and ordered to be split up. Although a breakup was reversed on appeal, Microsoft continues to abide by restrictive rules.

In Google’s case, a second trial now will still be held to rule on “remedies,” a process that could take months. Google has vowed to appeal, a process that will take years.

A possible outcome is that Google will no longer be allowed to pay billions to Apple and Samsung as their mobile phones’ default search engines. Last year, it reportedly shelled out $20 billion to Apple. That’s big bucks. If Google no longer can make these payments, it could save billions, while Apple would lose. In that case, a ruling designed to hurt Google might instead end up wounding one of its main competitors.

The outcome will depend on whether Google search remains superior to competitors. Although the inability to lock in search queries from iPhone or Samsung mobiles could reduce the number of Google search queries – and their lucrative advertising revenue – even the most radical remedies look unlikely to shake Google’s dominance.

Shutting off from Google funding, Apple and Samsung could build their own search engines. That means starting from scratch. Apple and Samsung could sign contracts with Microsoft’s Bing or other search engines like DuckDuckGo, boosting Google’s rivals. Microsoft has the deep pockets to pay and the motivation. Chief Financial Officer Amy Hood said last year that the company would get about $2 billion in ad revenue for every percentage point Bing gains in market share.

Although it takes only a few clicks to switch search engines, most consumers don’t bother. Bing has been stuck at a 4% market share, despite trying to catch up for decades, suggesting that users will continue to prefer Google, even if it is no longer the default.

One potential remedy under consideration is to require browsers and phone makers to ask consumers which search engine they want to use when setting up their devices. Europe ordered such a change in 2020, implementing a “choice screen” for Android devices. It failed to dent Google’s dominance. According to data from Statcounter, Google’s share of mobile searches in Europe has remained above 95%.

Even Judge Mehta acknowledges the difficulty of finding a way of boosting competition. “Google has not achieved market dominance by happenstance. It has hired thousands of highly skilled engineers, innovated consistently, and made shrewd business decisions,” he wrote in his decision. “The result is the industry’s highest quality search engine, which has earned Google the trust of hundreds of millions of daily users.” In contrast, the judge acknowledged that Microsoft failed to adopt Bing for mobile phones, losing ground.

Of course, US judges or European regulators could order a dramatic punishment — a court-ordered breakup. Google would then need to sell or spin off its browser and Android mobile operating system from the search engine or some of its advertising and cloud arms. But this “nuclear” option looks unlikely. During the long Microsoft antitrust saga, the company overturned a breakup.

What could change the landscape is innovation. As my experience with browsers demonstrates, superior products can bust open monopolies. Consumers will flock to a search engine that is demonstrably better than Google’s. Artificial intelligence could create such a superior product. Instead of typing in queries to a traditional search engine, users could get answers from ChatGPT and other AI applications. Microsoft-backed OpenAI just released its own search engine.

Google has its own powerful AI search products. It will have to keep improving its services to stay ahead of Microsoft, not to mention fast-growing AI startups. If Google fears cannibalizing its current business and does not provide the best search experience, it will suffer.

After the US verdict, Google parent Alphabet shares didn’t plunge. They edged up. Investors realize that any final resolution of the antitrust war is long off. Google lost a battle. It is far from losing the war

Bill Echikson is a non-resident Senior Fellow for CEPA’s Digital Innovation Initiative and editor of Bandwidth. He worked at Google from 2008 until 2015.

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

2025 CEPA Forum Tech & Security Conference

Explore the latest from the conference.