Europe wants to go digital. Washington wants to go transactional. Brussels’ push for tech sovereignty risks clashes with the US — it’s already provoking them — but how far can Europe go to disengage from US tech?

The European Commission recently unveiled its long-anticipated Startup and Scaleup Strategy, a blueprint for boosting the continent as a place to launch and grow technology-driven innovative companies. These goals threaten to collide with President Trump’s push to end what he considers European discrimination against US companies.

The trigger? Europe’s long-dormant Digital Services Tax could provide the ammunition for a transatlantic tech clash. First floated in 2018 and quietly sidelined during OECD global negotiations, the White House’s tariff offensive has put back on the table a potential Europe-wide tax on US tech services.

The risks are gigantic. The US administration has set a deadline of July 9 for a trade deal to be reached with the European Union, after which 50% tariffs will come into force. Positive signs of rapprochement have emerged: President Trump has praised European efforts to boost defense spending and US Trade Representative Jamieson Greer said the EU had provided “a credible starting point” for trade talks.

But the digital tax question remains unresolved. President Trump’s “big beautiful” bill, making its way through Congress, contains provisions for a “tax sledgehammer” that would allow the President to retaliate against countries that impose special digital service taxes on large technology companies like Amazon and Alphabet.

The US administration’s America First trade doctrine targets perceived European “discrimination” against US tech firms. Europe’s first fines issued under its Digital Markets Act, designed to curb the power of big tech, reinforced these American fears.

For Brussels, the digital services tax is about more than just revenue – it’s a question of fairness. European officials point to US tech giants raking in hefty profits across the continent while contributing little in local taxes. The digital tax has become a cornerstone of Europe’s drive to raise money to pay for “digital sovereignty,” a theme that echoes through both the recently unveiled Startup and Scaleup Strategy and the European Commission’s 2030 Digital Compass.

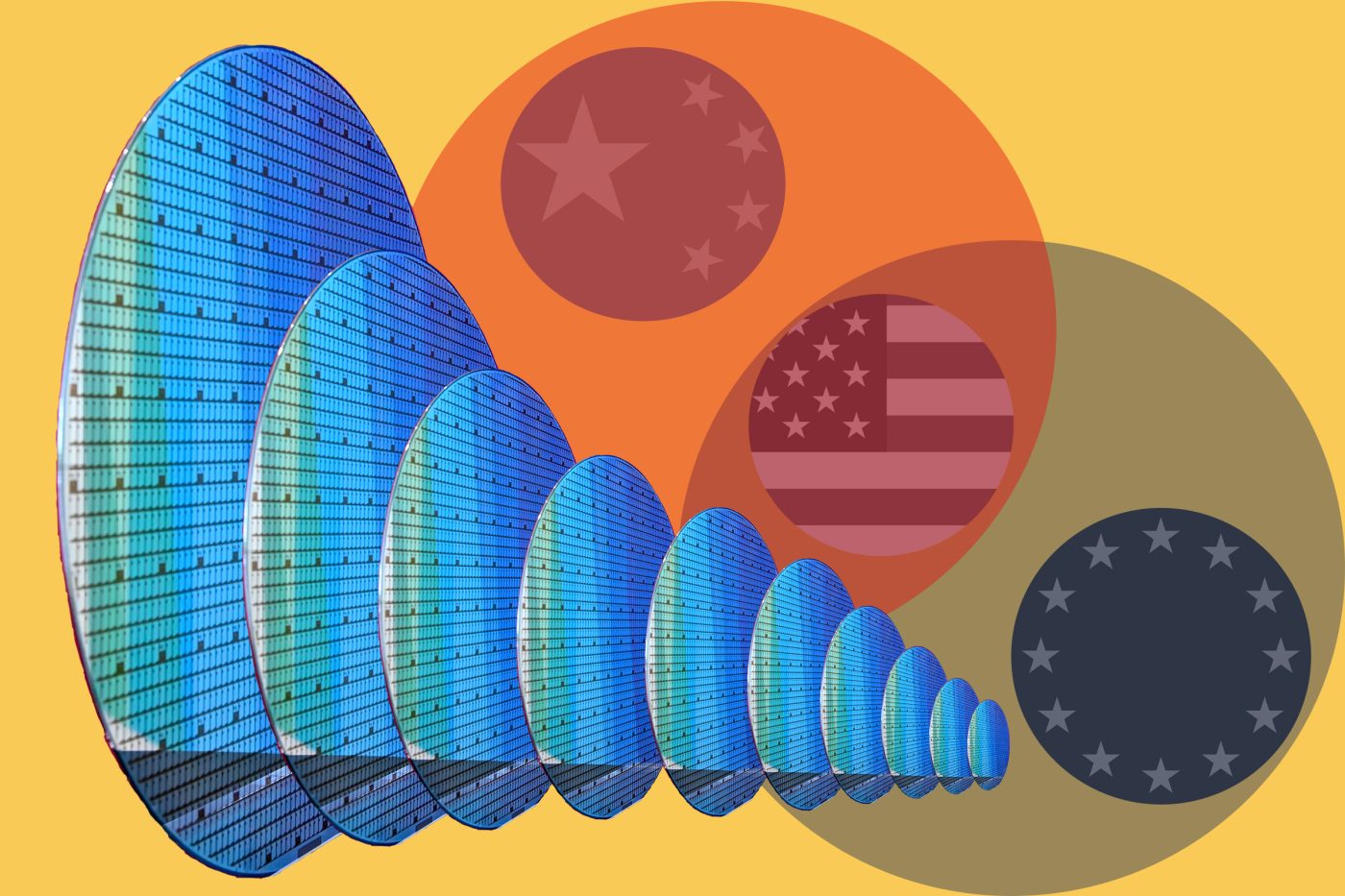

The Startup and Scaleup strategy outlines an ambitious agenda: harmonizing startup regulations, streamlining cross-border venture funding, and strengthening Europe’s digital infrastructure. Most notably, it proposes a public-private “Scaleup Europe Fund” to contribute to Europe’s technological sovereignty and economic security by backing deep-tech scaleups in areas like AI, semiconductors, and cybersecurity.

Can Europe truly go it alone in a digital world dominated by US giants and Chinese scale? Critics argue that any digital services tax, if implemented unilaterally, could prompt retaliatory tariffs that hit precisely the sectors Brussels hopes to grow. It’s a high-stakes dilemma: push for digital sovereignty and risk being sidelined from key global supply chains, or step back and accept a marginalized role in tomorrow’s economy.

The tussle over digital taxes represents just one flashpoint in a growing transatlantic digital divergence. From cloud infrastructure to AI rulebooks, Brussels and Washington are charting separate courses. Europe is leaning into regulation, ethics, and competitive balance. The US model – especially under President Trump — favors speed, scale, and economic leverage.

For startups in Berlin, Madrid, or Paris, this divergence creates uncertainty. Will it cost more to access US capital, or will cloud infrastructure become more expensive? European founders may also face new costs when exporting tech products or software services to the US.

By cutting reliance on foreign capital and strengthening domestic tech ecosystems, the EU hopes to cultivate its own “sovereign” unicorns. But without reliable access to U.S. markets – or potentially worse, with tariffs looming — that vision could struggle to take off.

Brussels faces an uphill battle in pitching its vision of a prosperous digital economy, one that fosters innovation while keeping dominant platforms in check. The Trump administration wants an end to what it sees as unfair targeting of US big tech.

Navigating the politics of a digital tax will also require meticulous diplomacy. Europe should consider how to align its tax policies with global standards, perhaps by pushing for a fast-track revival of the OECD talks. A coordinated approach would be far less likely to trigger retaliatory tariffs – and more likely to yield sustainable results.

With its new Startup and Scaleup Strategy, the EU is charting an ambitious, self-sufficient digital future. A digital trade showdown with Washington threatens to derail these ambitions. Although competing against the US may be the goal, collaboration – not conflict – must be the starting point.

Padraig Nolan is a Non-resident Fellow with the Tech Policy Program at the Center for European Policy Analysis (CEPA). He serves as Chief Operating Officer of ETPPA, a prominent EU fintech association. He is also an advisory board member of the Lisbon-based Europe Startup Nations Alliance. Padraig holds a bachelor’s degree in law and economics (University of Galway) and a master’s degree in European law (Utrecht University).

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

2025 CEPA Forum Tech & Security Conference

Explore the latest from the conference.