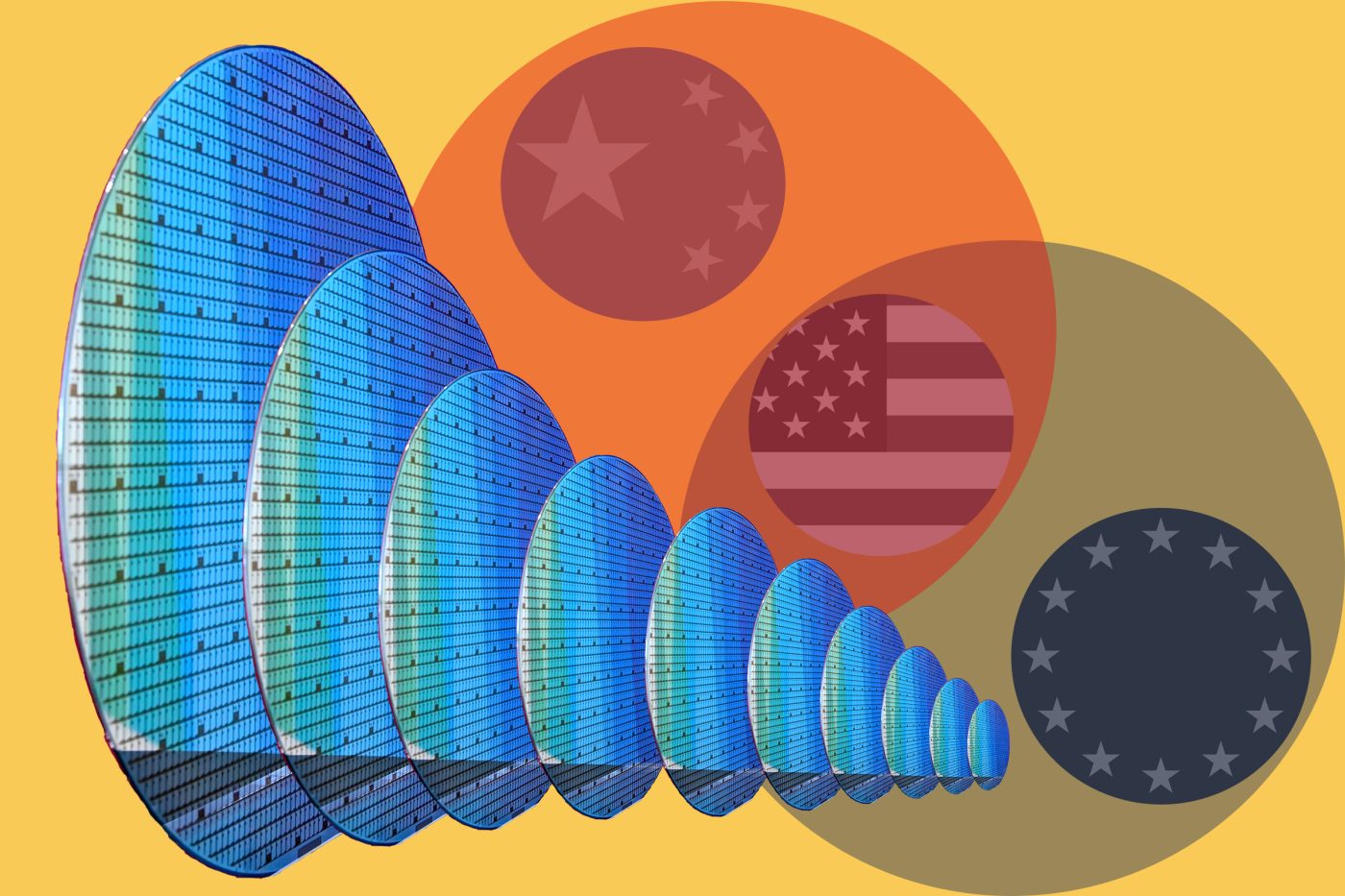

It looks, at first glance, like a bureaucratic footnote: in the recent US Critical Minerals List, Washington added phosphate. But the addition signals a deep shift: the recognition that mineral inputs for agriculture belong in the same strategic category as those for semiconductors.

The updated critical minerals list replaces the one from 2022 and reflects a change in methodology: instead of simply flagging supply vulnerabilities, the new framework gauges each mineral’s potential to inflict GDP-level economic damage in the event of a disruption. It identifies 60 minerals as strategically essential, adding copper, silver, coal, uranium, rhenium, silicon, lead, potash, and of course, phosphate. The result aligns with how the US now understands national security — through the lens of systemic economic risk and strategic supply-chain resilience.

Phosphate rock, the geological backbone of modern fertilizers, is concentrated in a few countries. Morocco’s OCP Group claims access to over 70% of reserves. In potash, Russian and Canadian players account for the bulk of global production. Canada is the world’s leading producer, accounting for more than a third of global production, followed by Russia at about 19%.

These are not just commodity statistics. They describe a world in which a handful of states sit atop the geological levers of global food production. Morocco’s phosphates and Canada’s and Russia’s potash give those countries influence far beyond their borders.

Count in China, too. It accounts for nearly half of all phosphate rock mined globally, and controls more than 40% of the export trade in chemical calcium phosphates. This position effectively makes Beijing the swing actor in the world’s supply of phosphorous inputs. When Chinese authorities tighten export controls on fertilizers — as they have periodically done — they underline a powerful weapon.

China’s grip is just as firm on the nitrogen side. It is a heavyweight producer of urea, supplying about one-tenth of global exports, and its sprawling industrial base commands roughly 43% of global nitrogen fertilizer revenues. In practice, that means a single country’s policy choices can reshape the cost of growing food across entire continents.

The global fertilizer market is projected to grow from roughly $230 billion in 2025 to about $281 billion by 2030. Demand for the underlying mineral inputs — phosphate rock, potash and nitrogen precursors — is rising in tandem. The global phosphate rock market alone was valued at about $22 billion in 2021 and is projected to reach almost $30 billion by 2030.

Europe’s wake-up call came abruptly with the war in Ukraine. Suddenly, the continent discovered that its fertilizer supply — and in turn, its food security — depended on Russian natural gas, Russian nitrogen, and Russian and Belarusian potash. The EU imported phosphorus fertilizer and phosphate worth close to €1 billion in 2024, making up about 25% of its total phosphorus fertilizer imports. The European Commission acknowledged that over-reliance on Russian and Belarusian suppliers represented a structural vulnerability.

The US faces a subtle version of the same vulnerability. Russia and Belarus continue to shape global potash flows, despite sanctions and export-burden risk. For a country that prides itself on agricultural abundance, the US is discovering that abundance does not always equate to resilience. When China clamps down on exports, as it has in recent years to shield its own farmers, global prices jolt upward, and import-dependent nations feel the squeeze almost overnight.

For both Washington and Brussels, the lesson is becoming clear: food systems are shaped by supply chains as fragile as those for lithium or microchips. Viewed in that light, the US decision to classify phosphate as a critical mineral marks the beginning of a major strategic realignment.

Elly Rostoum is a Resident Senior Fellow with the Center for European Policy Analysis (CEPA).

Bandwidth is CEPA’s online journal dedicated to advancing transatlantic cooperation on tech policy. All opinions expressed on Bandwidth are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.

2025 CEPA Forum Tech & Security Conference

Explore the latest from the conference.