At recent bilateral summits, US officials have expressed concerns over a European ‘5G Nokia-Ericsson duopoly’ in telecoms infrastructure. Their European counterparts argue – correctly, as we will show – that the Nordic telecom dominance is negligible compared to that of US ‘Big Tech.’

Brussels seems hell-bent on tackling Silicon Valley’s dominant ‘online platforms.’ This loosely defined concept can refer to virtually any company that is successful, challenges old-fashioned business models – and therefore, is rarely European. The upcoming Digital Services Act and Digital Markets Act target search engines, shopping and booking sites, operating systems, and a host of other service providers.

US diplomats and lobbyists object, saying that the Internet giants, even those possessing de facto monopolies, operate in well-functioning markets. True to the theory of “dynamic competition,” market shares of up to 93 percent are not necessarily problematic and could be conducive to innovation. From this standpoint, Americans argue, EU regulations and antitrust must be ‘protectionist.’

The US government, on the other hand, subjects 5G technology to close scrutiny, running a well-publicized campaign against Chinese telecom infrastructure giant Huawei’s sales to Europe. Ironically, the Chinese telecom vendors never gained a foothold in the US and never threatened US national security.

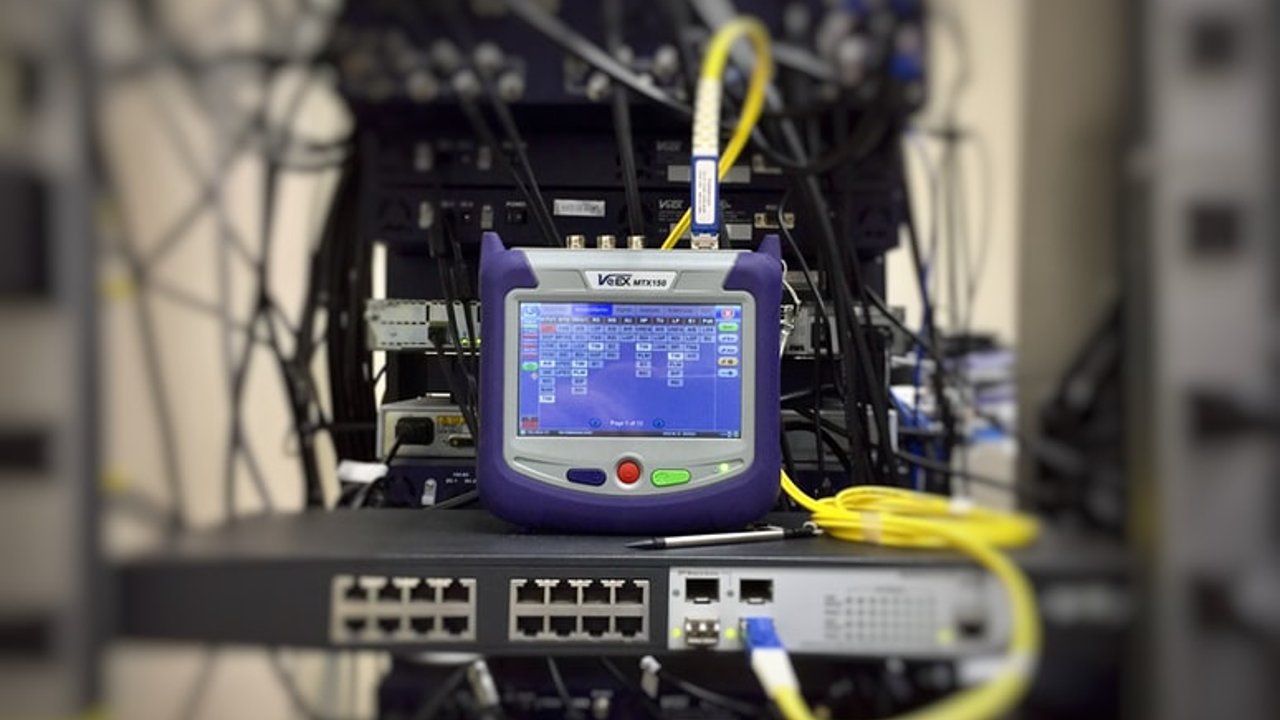

More recently, US policymakers have expressed concerns over Ericsson and Nokia’s ‘5G duopoly’ in US telecom infrastructure. An alternative technology, developed by Chinese and US cloud companies, called ‘Open RAN’ has been hailed as a possible solution to break the dominance of European players. The United States Innovation and Competition Act has pledged billions of potentially non-WTO compliant subsidies to create American Open RAN alternatives.

Somehow, the same people who see no problems with US companies becoming monopolists in Europe express grave concern and advocate for state assistance to combat an alleged Scandinavian duopoly.

Binary, mercantilist sentiments are misguided. Given their history, these ‘European’ vendors are barely even European. Two North American industry champions – Nortel and Lucent – merged with Ericsson and Alcatel respectively to form transatlantic entities. The Finnish-German conglomerate, Nokia Siemens Networks, acquired the French-American champion These global firms are Scandinavian in name only. To this day, Nokia employs a larger R&D staff inside the US than the rest of the US industry (vendors and operators) combined.

Before advocating for network infrastructure alternatives, it is worth comparing the ‘Ericsson Nokia Duopoly’, to the dominance of US ‘Big Tech’. While Ericsson and Nokia enjoy a majority market share in North America, this analysis compares them to the role of US Big Tech in European markets.

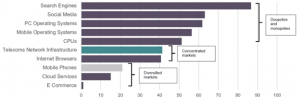

Figure 1: Concentration of Transatlantic Technology Markets.

Figure 2: Country of origin in Technology Markets

Source: (Dell’Oro, 2021; Statcounter, 2021; Statista, 2021).

Figure 1 shows that digital technology lends itself to concentrated markets. Dynamic competition and network effects combine to produce efficient firms that create innovative ecosystems and temporary monopolies.

Telecoms infrastructure has benefitted from global standardization which has yielded massive economies of scale and universal interoperability at a relatively modest cost. The industry reports profit margins in the single digits at best (or large losses at worst).

This stands in stark contrast to US internet giants that routinely generate around 30 percent margins. The entire global industry-wide turnover of telecoms network equipment is less than the annual profits of just one US platform company.

The conclusion seems indisputable: policymakers are concerned by nation branding and handing out subsidies rather than the sanctity of competition. If the US – dominant in most tech industries – tries to justify discriminatory state aid as a response to EU platform rules, the Western Alliance will have lost its way.

Hosuk Lee-Makiyama is the director of the ECIPE think tank in Brussels. Robin Baker is a Research Associate at the London School of Economics