Ever since the Kremlin unleashed its wanton campaign of chaos in Ukraine, the world’s democracies have worked to increase sanctions pressure on the Putin regime to end its criminal aggression. Policymakers on both sides of the Atlantic have focused on measures to starve the Russian government of the revenues needed to bankroll Putin’s war machine.

Financial and banking restrictions have led Russia to default on its foreign debt for the first time since the Bolshevik revolution, while energy export sanctions aimed at depriving the Kremlin of profits from hydrocarbon sales continue to be announced.

On the energy front in particular, much more needs to be done to shore up Europe’s energy security, while emptying Putin’s pockets through enhanced energy sanctions measures — as I told US Senate and House Members of the Committee on Security and Cooperation in Europe in a hearing on Capitol Hill last month.

But there are other measures to consider — namely technology restrictions — that are also underway to limit Russia’s ability to wage war while isolating it internationally across a variety of fields. Of note is the system of export controls deployed across many democratic states aimed at limiting the Kremlin’s ability to source key technologies to enable its war effort. This includes those components and subsystems that might not at first glance appear to be themselves of military application, but could be cobbled together to form vital parts of larger defense system designs – so called “dual-use” technologies.

So far, the strategy appears to be working.

A July report by a group of Yale University economists suggests sanctions are having a devastating effect on Russia: “Looking ahead, there is no path out of economic oblivion for Russia as long as the allied countries remain unified in maintaining and increasing sanctions pressure,” it stated. “Defeatist headlines arguing that Russia’s economy has bounced back are simply not factual,” largely because the Kremlin is now visibly tinkering with the figures.

The authors add that “despite some lingering leakiness, Russian imports have largely collapsed, and the country faces stark challenges securing crucial inputs, parts, and technology from hesitant trade partners, leading to widespread supply shortages within its domestic economy.”

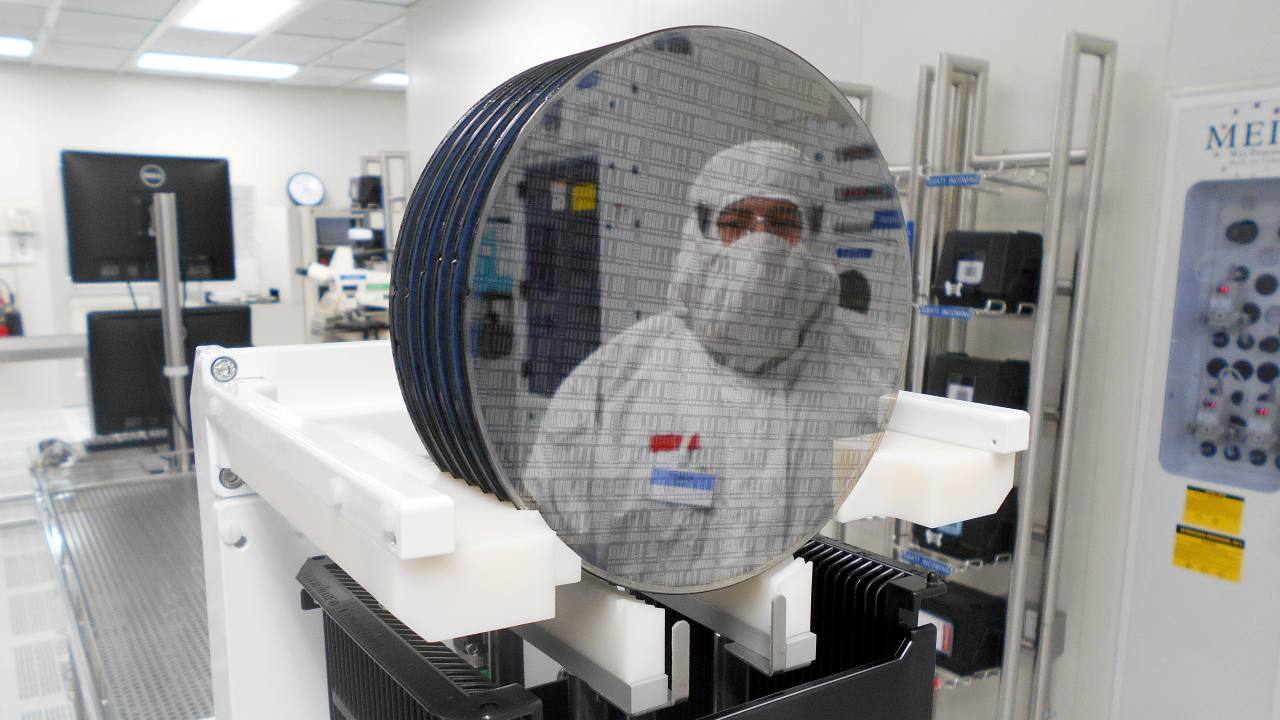

U.S. officials tend to agree. In Congressional testimony on 11 May, US Commerce Secretary Gina Raimondo highlighted that: “U.S. technology exports to Russia have fallen by nearly 70%” since the onset of sanctions just days after the February 24 invasion. Raimondo underscored reports from Ukrainians — which have been percolating on social media for months now — that upon inspecting captured or destroyed Russian military equipment, “it’s filled with semiconductors that they took out of dishwashers and refrigerators.”

Normally loath to provide any admission that Western sanctions impact the Russian government or society, sanctioned Russian President Vladimir Putin has started to betray this narrative. On 14 July, Putin signed into law so-called “special economic measures to support the Russian armed forces during ‘counter-terrorism and other operations’ outside the country.” The measures appear to be a (very) Kremlin analog to the US Defense Production Act, reportedly geared to force firms to “accept government contracts” and employees “to work at night and on holidays,” while streamlining measures to requisition assets of the Russian state reserve.

In the end, it might not make a substantial difference.

Years of export restrictions on technology transfers to Russia stemming from its initial 2014 illegal annexation of Crimea and invasion of Eastern Ukraine had already greatly impeded Russia’s technology sector, and further export controls imposed since February have made the situation even direr for the country. So even if ordered by the Kremlin to accept a particular government contract, a given firm might still be unable to fulfill the demand due to hardware supply chain and software limitations owing to Western export controls.

Recent statements from US Department of Commerce Undersecretary for Industry and Security Alan Estevez underline the situation. According to Estevez, sanctions have led to a 99.9% drop in US aviation and aerospace technology sales to Russia, while global semiconductor export controls measures have resulted in a 90% drop of transfers to Russia, blocking off a key component for everything from consumer goods and military hardware to IT equipment and related advanced technologies. As the Financial Times reported, dual-use technology sanctions on high-tech consumer electronics like “smartphones, networking equipment, and data servers” have limited Russia’s ability to harvest semiconductors from these finished systems, just as it has been limited by export controls on the components themselves.

These sanctions have also made Russia “unable to access 5G equipment” meaning that it will likely be unable to upgrade to the state-of-the-art 5G telecommunications standard, instead potentially scrambling to hang on to the status quo by “buy[ing] up outdated 4G equipment on the secondary market from countries that have already moved on.”

Moreover, announced exits from the Russian market by enterprise software firms like IBM and Microsoft, and productivity software platforms like Adobe and Slack, have the potential to impact Russian business development the longer the withdrawals last, as Russian firms become unable to access vital security patches and technical support. Additionally, the exit of Computer Aided Design and Manufacturing (CAD/CAM) engineering software giants like France’s Dassault Systèmes (maker of the SOLIDWORKS), Boston-based PTC (maker of PTC Creo), and Bay Area-based Autodesk (maker of Autodesk Inventor and Revit) could hamper fields ranging from mechanical and electrical engineering design, to computer-integrated manufacturing, to building information modeling — all prerequisites for a well-functioning high-tech sector.

With the pressure rising, on 18 July, Putin again admitted to feeling the bite of technology export controls, lamenting that the measures are contributing to “the colossal amount of difficulties [Russia] is facing,” but defiantly vowing that the government would “look for new solutions in an energetic and efficient manner.”

It’s a tall order and Putin seems ill-equipped to offer any new, substantive solutions. Instead, he reverted to his well-worn autocratic instincts: putting public pressure on subordinates by calling for “detailed proposals from both the finance ministry and the Bank of Russia,” sarcastically calling on Russian state-owned-enterprises “who do not know what to do with billions of dollars in accumulated resources” to invest in the tech sector, and peppering his comments with criticism of state-owned military conglomerate Rostec for good measure.

There may not be much hope of quick solutions to ramp up an already beleaguered Russian tech sector; Barron’s reported that “at the same meeting, Deputy Prime Minister Dmitry Chernyshenko said that the Russian IT sector would overcome the adverse consequences of the sanctions in three to five years.”

In the absence of any better idea, Putin has reverted to another well-worn anti-sanctions tactic: energy weaponization.

Recall that last month, Gazprom slashed natural gas flows via the Nord Stream 1 pipeline to Germany by 60%, attempting to explain away this clearly politically-motivated reduction as a technical necessity owing to what the Kremlin-controlled entity claimed were urgently needed Siemens gas turbines undergoing maintenance in Canada. Not coincidentally, these could not be returned to the Russian Federation due to Canadian export controls on energy technology transfers.

Since the cuts took place, the German government has issued several statements assessing Gazprom’s justification as a fraud, including a Bundesnetzagentur statement claiming it could not “identify any causal connection between the missing gas compressor on the Russian side and the big reduction in supplies,” and from Germany’s Federal Ministry of Economic Affairs and Climate Action, which clarified that the requested “turbine was a replacement part that was meant to be used only from September, meaning its absence could not be the real reason for the fall-off in gas flows prior to maintenance.”

And yet, astonishingly — and counter to its own assessment — the German government heavily pressured the Canadian government to undermine its own energy technology sanctions regime, claiming that if Canada didn’t waive its export controls, Germany would be thrown into immediate economic turmoil that would result in civil unrest forcing it to end military and economic support for Ukraine. This is a questionable conclusion and gives too little credit to the German electorate, some 70% of whom — according to a recent survey — want to continue support for Ukraine despite high energy prices.

Canada relented, allowing the first of the six turbines covered by Ottawa’s waiver to be flown to Germany last week, awaiting transfer to the Russian Federation. Even if the turbine transfer is allowed by an exemption in EU sanctions policy for existing equipment, it should be noted that in March, the EU’s fourth package of Russia sanctions included measures that would prohibit “new investments in the Russian energy sector and exports of energy-related equipment to the country.” Germany’s pressure against similar export controls taken by other Transatlantic partners like Canada provides a troubling example at a time when sanctions unity is needed more than ever to stave off the self-fulfilling prophecy of “Ukraine fatigue” in Europe.

Given the growing success of broader technology export controls measures that democracies have arrayed against the Putin regime, the Siemens turbine row goes well beyond the status of a single pipeline route. It sets a worrying precedent that the Kremlin will take on board as a lesson: weaponizing energy and natural resource dependency can be an effective tool to break down technology export controls regimes that are beginning to curb Russia’s military potential and its economic engine for warfighting.

This is why I coauthored a statement last week along with members of the Stanford-organized International Working Group on Russian Sanctions, calling on Canada to reverse its waiver, and for Germany and the US to publicly support the reversal.

In a struggle as dire as Russia’s criminal onslaught against Ukraine, Putin and his authoritarian cronies need to see a wall of strength from democracies – unwilling to waver in their resolve to hold the Kremlin to account. Technology export controls against Russia are working; democracies should keep expanding them.

Then the only nation forced to change its political calculus due to “Ukraine fatigue” will be Putin’s Russia.

Dr. Benjamin L. Schmitt is a Research Associate at the Harvard-Smithsonian Center for Astrophysics, a Senior Fellow for Democratic Resilience at CEPA, and co-founder of the Space Diplomacy Lab at the Duke University Center for International and Global Studies “Rethinking Diplomacy” Program. (Twitter: @BLSchmitt)

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions are those of the author and do not necessarily represent the position or views of the institutions they represent or the Center for European Policy Analysis.