Central European states remain America’s staunch allies for good reasons. As in all close relationships among countries, the ties that bind across the Atlantic span multiple dimensions. They cement what we can call a “natural alliance” of shared values, historical partnerships, political culture and economic ties.

The latter link—built around long-term economic potential—tends to be overlooked by Central European policymakers. Their tropism naturally leans toward the European Union, whose customs union, open borders and geographical proximity influence trade and investment flows. Yet the tactical arguments about the depth of the transatlantic relationship—minimum defense budgets, joint military operations or a NATO commitment under Article 5—will not substitute for the strategic gravitas of economics. Economic strength translates into military power, which in turn leads to political and diplomatic influence. The economic wealth of a country enhances its strategic value to the United States regardless of transient political shifts, be they in Washington, Warsaw or Bucharest. Central and Eastern European allies ought not to lose sight of this important dimension. This might become especially relevant if negotiations over the Transatlantic Trade and Investment Partnership (TTIP) were to fail.

What are the economic channels through which this strategic value manifests itself in the United States? There are many, but three will suffice to make the point: economic dynamism, American direct investmentand trade.

Economic wealth and income in partner economies directly drive their demand for imports, which are America’s exports. Goods and services sold overseas augment domestic income, jobs and ultimately America’s stock of wealth. Economic dynamism and high wealth of a country’s citizens foster political stability and rule of law. These factors attenuate risks to U.S. investors and businesses operating overseas. Americans have a stake in allying themselves with richer rather than poorer partners. Finally, affluent allies can afford stronger militaries.

U.S. companies invest abroad in order to extend their domestic marketplace. Higher strategic outbound direct investment leads to higher domestic employment and income, mostly through exports of goods, services and know-how between subsidiaries. At the same time, seen from the receiving end, these investments add to the productive capacity of allies, making them stronger economically, more secure and ultimately more dependable. With lots of American capital sunk into partner economies, U.S. taxpayers would be more willing to defend their money should an ally come into conflict with an adversary.

Trade is a lever for economic prosperity. Imports from partner economies enrich U.S. consumers who benefit from a wider choice of goods and services. Foreign goods heighten domestic competition, which in turn leads to greater efficiency for all. Trade binds economic partners into a web of joint ventures and investment flows. Internationally recognizable brands carry the goodwill of exporting countries. One could say that trade is diplomacy by other means. It makes sense for close allies to trade a lot.

How do Central European countries compare as economic partners of the United States in a historical perspective? This note takes a trio of America’s close allies from East Asia (Japan, Korea and Taiwan, or EA3) and traces their economic ties to the United States over a similar stage of development as that of the core of Central Europe (Czech Republic, Hungary, Poland and Slovakia, or CE4). For EA3, that period roughly spanned the 1960s through 1980s, and for CE4 the 1990s through today.

There are good reasons to compare the two groups. All seven countries had emerged from conflicts or systemic transitions when the United States recognized them as potential strategic allies. The EA3 entered into bilateral defense ties with the United States just before their economic takeoff in the 1960s. The CE4 joined NATO in 1999 (and Slovakia in 2004), just prior to their 2004 accession to the EU. Both groups were at similar stages of development at the outset of the comparison period. All seven economies transitioned from mostly agrarian to mostly industrial societies by benefitting from the openness of their partners’ economies.

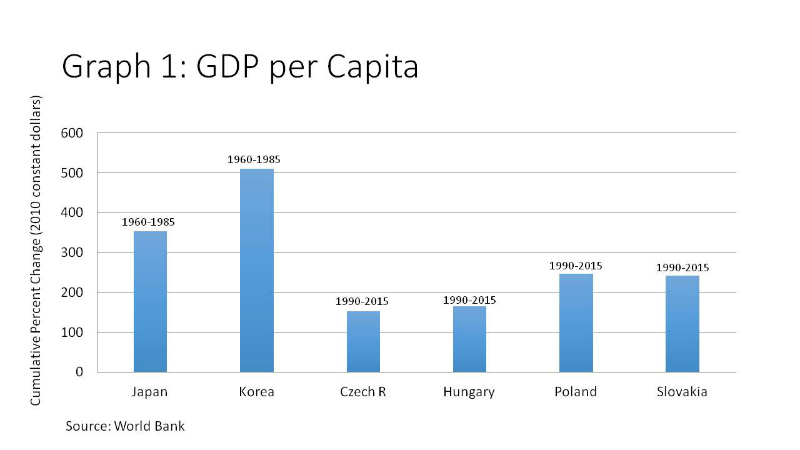

Per-capita GDP will serve as a proxy for economic dynamism (graph 1). At the outset of the respective 25-year periods, the Czech Republic in 1990 was the richest and Korea in 1960 the poorest economy when expressed in 2010 U.S. dollars, adjusted for inflation. By the same measure, Japan had roughly the same per-capita GDP in 1960 ($8,700) as Hungary did in 1990 ($8,800). Poland and Slovakia placed just below the two. In all countries, except for the two outliers (Czech Republic and Korea), annual per-capita GDP was clustered in a tight range of $7,000 to $9,000.

The Asian trio grew significantly faster over the subsequent two and a half decades than did the CE4. The Korean economy expanded by 500 percent—twice as fast as the best European performers, Poland and Slovakia (250 percent) while Japan’s economy grew 350 percent over that same period. In terms of pure economic dynamics, the Asian tigers shone more brightly than the European ones over the comparable quarter-century periods.

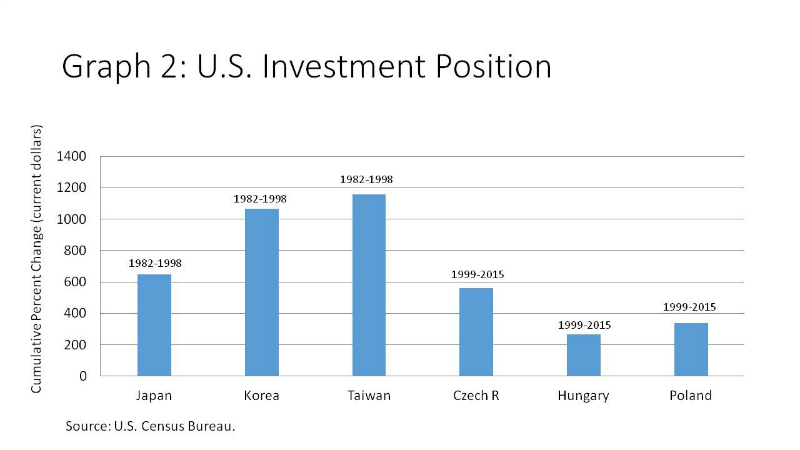

The investments American companies make abroad represent a strategic outpost of U.S. wealth. They include savings ordinary citizens place through their pension and mutual funds. Graph 2 depicts a change in a cumulative stock of American investment abroad. Whereas U.S. companies built factories in Korea and Taiwan on average three or four times faster than in Hungary or Poland over the 17 years studied here, the difference between Japan and the Czech Republic was far smaller (640 percent vs. 560 percent). These figures do not adjust for population, and hence, economic size. When expressed on a per-capita basis, the Czech economy attracted U.S. capital at a slightly faster clip than Taiwan, Hungary at a faster rate than Korea, and Poland at a faster rate than Japan.

If economists agree on only one paradigm, it is that the extension of a domestic market through foreign trade enhances welfare for both partners. Graph 3 portrays U.S. import dynamics over a 15-year period. The picture is compelling. Whereas imports from Poland and Slovakia grew the fastest, the cumulative growth rate of imports from Hungary was comparable to those from Taiwan and Japan, while the rate for the Czech Republic was the same as for Korea.

In aggregate, the Asian economies represented a larger economic potential in 1960 than the Central European ones in 1990 because they were twice as populous. In subsequent decades, however, the two groups performed well in all categories considered here as enhancing the welfare of the United States. The EA3 developed faster than the CE3, but investment and trade links grew at comparable rates.

One dissimilarity stands out between the two groups. The EU has bound the CE4 into a natural alliance that spans a customs union, a unified labor market and shared political sovereignty over selected jurisdictions. The Asian side has no comparable body to the EU. The United States served as the sole “role model” for the EA3 throughout its formative growth period. China may represent a large market but it is not normative for the EA3 in the way that the EU has been for the CE3. Given the EU’s institutional pull, the close and fast expanding economic ties between the United States and the CE4 seem even more remarkable.

That said, Central and Eastern European policymakers would be foolish to brag about historical achievements or rest on their laurels. Europe’s population has stagnated or is falling, while Asian economies keep delivering technological prowess to the rest of the world. Some things must change to support the economic gravitas the CE4 carries within the transatlantic relationship.

First among them is keeping overall economic momentum high. GDP growth rates have moderated over the past 10 years, slowing down the convergence with Western European averages. Keeping the economic potential high, as the Asians have delivered beyond their initial takeoff stage, will help deepen the alliance.

Second, a natural imbalance in the direction of strategic investment has developed. It will be to the benefit of both the Europeans and Americans to correct it. In the 1990s and well into the past decade, direct investment flowed primarily from the United States to Central Europe; the reverse flow was always marginal. More recently, direct investments sourced from the CE4 have picked up, albeit from a small base. In absolute terms, they are still insignificant when compared to U.S. investments in Central Europe. The lesson of the Asian tigers is instructive here. The EA3 became successively more competitive when those countries tapped the U.S. market directly. Central European governments should support their nascent mid-sized companies’ forays across the Atlantic. When the currently scant footprint of CE4 companies grows in the United States, Washington and state capitals will nod approvingly. Additionally, higher foreign direct investment fuels growth in trade as internationally minded companies develop global supply chains. In fact, most trade in goods today takes place between subsidiaries.

Finally, the Central Europeans have all the ingredients to move up the value chain, and ought to seize the opportunity. They are entrepreneurial, the quality of their primary and secondary education tops the charts, and they operate under rule-based legal systems. What they lack is quality tertiary education and the environment for scaling up. Again, taking a page out of the Asian book, European governments would be well advised to support opportunities for college and graduate study at first-rate universities abroad. This is what the Japanese and Korean governments did decades ago. The CE4 needs to drastically overhaul its antiquated university environment, but that will take years to put through.

The Central Europeans are staunch U.S. allies for good reasons. They should not lose sight of the economic underpinning of this relationship. It is the best guarantor of a stable security architecture in the region.

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions are those of the author and do not necessarily represent the position or views of the institutions they represent or the Center for European Policy Analysis.